The U.S. Federal Bureau of Investigation (FBI) on Monday warned

of cyber criminals increasingly exploiting flaws in decentralized

finance (DeFi) platforms to plunder cryptocurrency.

“The FBI has observed cyber criminals exploiting vulnerabilities

in the smart contracts governing DeFi platforms to steal investors’

cryptocurrency,” the agency said[1] in a notification.

Attackers are said to have used different methods to hack and

steal cryptocurrency from DeFi platforms, including initiating

flash loans that trigger exploits in the platforms’ smart contracts

and exploiting signature verification flaws in their token bridge

to withdraw all investments.

The agency has also observed criminals defrauding the platforms

by manipulating cryptocurrency price pairs – assets that can be

traded for each other on an exchange – by exploiting a series of

vulnerabilities to bypass slippage checks[2]

and steal roughly $35 million in digital funds.

It further said that the threat actors are looking to take

advantage of the growing public interest in cryptocurrencies, once

again indicating the opportunistic nature of the attacks.

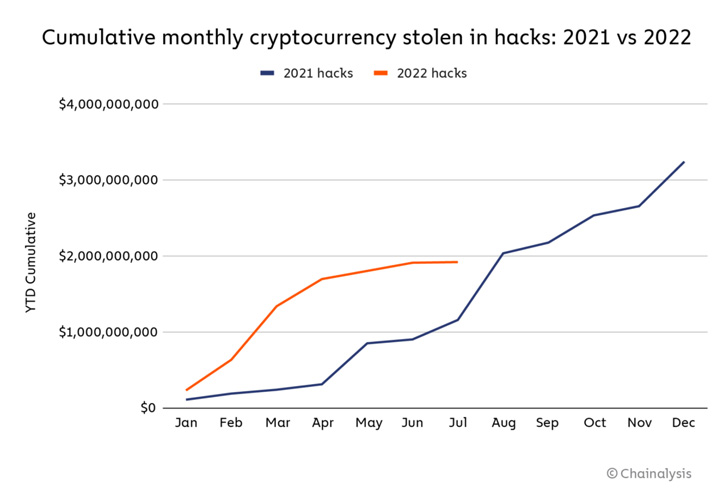

Indeed, losses arising from cryptocurrency hacks have jumped

nearly 60% in the first seven months of the year to $1.9 billion,

propelled by a “stunning rise[3]” in funds stolen from

decentralized finance (DeFi) protocols, a report from blockchain

analysis firm Chainalysis revealed this month.

“DeFi protocols are uniquely vulnerable to hacking, as their

open source code can be studied ad nauseum by cybercriminals

looking for exploits (though this can also be helpful for security

as it allows for auditing of the code), and it’s possible that

protocols’ incentives to reach the market and grow quickly lead to

lapses in security best practices,” the company noted[4].

Much of the hacks against DeFi services have been attributed to

the North Korea-affiliated hacking unit known as the Lazarus Group[5], with the nation-state

adversary attributed to the theft of nearly $1 billion.

“Investors should make their own investment decisions based on

their financial objectives and financial resources and, if in any

doubt, should seek advice from a licensed financial adviser,” the

law enforcement authority said.

Additionally, it’s also recommending consumers to research about

DeFi platforms prior to investing, ensure their code has been

subjected[6]

to thorough audits[7], and be cognizant of the

risks posed by open source code repositories.

The advisory also arrives over a month after the FBI cautioned[8]

that malicious actors are developing rogue cryptocurrency apps to

defraud investors of their virtual assets.

References

- ^

said

(www.ic3.gov) - ^

slippage

checks (www.nasdaq.com) - ^

stunning

rise (blog.chainalysis.com) - ^

noted

(blog.chainalysis.com) - ^

Lazarus

Group (thehackernews.com) - ^

subjected

(thehackernews.com) - ^

thorough

audits (thehackernews.com) - ^

cautioned

(thehackernews.com)

Read more https://thehackernews.com/2022/08/fbi-warns-investors-to-take-precautions.html